In the UAE, numbers are not just entries in a ledger. They are contracts, compliance, credibility. Choosing from the Top 10 Accounting software in UAE is not a purchase decision. It is a long term investment in your company’s stability.

In Dubai’s fast moving economy, selecting the right Accounting software Dubai businesses rely on determines how confidently you face audits, tax filings, and expansion. The Best Accounting software in Dubai must go beyond invoicing. It must support Corporate Tax, VAT, payroll aligned with UAE Labour Law, and import export documentation that meets government standards.

Choose the wrong system, and the pain is real. Data migration, broken audit trails, retraining staff, delayed VAT filings, operational disruption. Rolling back software is not just technical. It is emotional, financial, and strategic damage.

UAE corporations operate under structured frameworks. Corporate Tax at 9%, VAT compliance, WPS payroll mandates, MoHRE regulations, customs reporting, industry specific needs like real estate, FMCG, finance, HR or Automotive Accounting Software for dealerships. You need VAT Compliant Accounting Software that speaks the language of regulators and bankers.

After reviewing and investigating deeply, and discussing with over 100+ UAE businesses across sectors, we have carefully selected the Top 10. Let’s dive in.

1 – Tally Prime (ERP 9)

TallyPrime UAE Edition is a desktop focused solution optimized for the UAE’s tax framework. Known for speed and offline capability, it suits trading, manufacturing, and heavy inventory businesses. Advanced warehouse tracking, batch management, and expiry control make it strong for distribution sectors. With VAT reporting and GCC banking integration, it remains a powerful choice for firms needing structured control beyond basic Accounting software Dubai systems.

Features of Tally Prime

- Native Features – Accounting, inventory, VAT module, bilingual invoices and POS, multi currency, cost centres, order processing, cash flow and ratio analysis, e invoicing support, basic payroll in some editions.

- UAE VAT compatibility – Yes, Fully VAT compliant for UAE

- Corporate Tax compatibility – No, Do not have a dedicated UAE CT module yet.

- FTA compliance – Yes, generates FTA compliant bilingual tax invoices and VAT return files

- POS compatibility – Yes, POS invoicing features and support for bilingual POS invoices.

- Retail & trading compatibility – Yes, widely used in trading and retail, strong inventory, batch tracking, multiple pricing, and GST / VAT features.

- UAE HR payroll compatibility – Limited, basic payroll exists within Tally configurations but UAE WPS specific support is usually via add ons.

Advantages of Tally Prime

- Very strong for SMEs in trading/retail,

- Offline / desktop friendly,

- Fast reporting,

- Bilingual invoices,

- Deep VAT features

Drawbacks of Tally Prime

- Traditional Old Style UI,

- Less native cloud than some rivals (cloud access often via third‑party hosting),

- Limited native HR / payroll for UAE,

- Advanced analytics need extra customisation.

Pricing & Packages

As of 2026 Q1& Q2 – Tally generally follows a “pay once” perpetual license model, though annual renewals are required for “Tally Software Services” (TSS) to access latest updates.

- Silver – AED 2,340 + VAT. (Single PC User)

- Gold – AED 7,020 + VAT. (Unlimited Multi User)

- TallyPrime Cloud – Starts from AED 63/month

Technical support & after service

- Call support – Yes

- Email support – Yes

- Premium support – Yes

Reviews and Ratings

- Google Rating – 4.3 / 5

- TrustPilot Rating – 4.1 / 5

- UAE Public Rating – 9.5 / 10

2 – Wafeq Accounting

Wafeq is a GCC built, FTA accredited cloud platform competing strongly in the UAE SME market. It generates Arabic and English VAT invoices, supports WPS payroll aligned with MOHRE, and offers API integrations ideal for e-commerce startups. Clean, modern, and automation driven, Wafeq is often considered among the Best Accounting software in Dubai for tech driven businesses seeking localized compliance without legacy complexity.

Features of Wafeq

- Native features – Bilingual FTA compliant invoicing, VAT & CT automation, expense and purchase management, basic payroll & employee expense claims, reporting, branch and multi organisation support, e invoicing QR codes.

- UAE VAT compatibility – Yes, Support UAE VAT, automated VAT calculations and reporting.

- Corporate Tax compatibility – Yes, explicitly supports UAE CT handling.

- FTA compliance – Yes, FTA aligned e invoicing and VAT reporting, generates FTA compliant invoices and VAT returns.

- POS compatibility – Limited, POS available via integrations, not a full native POS module.

- Retail & trading compatibility – Yes, designed for SMEs in UAE including trading, supports quotes, invoices, inventory, and tax on goods.

- UAE HR payroll compatibility – Yes, has payroll and expenses features, but full WPS or complex HR may still need add ons.

Advantages of Wafeq

- UAE focus design language,

- Bilingual Arabic English,

- Strong FTA compliance (VAT, CT, e‑invoicing),

- Good for SMEs wanting localised cloud software.

Drawbacks of Wafeq

- Less global ecosystem than QuickBooks / Xero,

- Scalability to very large enterprises may be limited,

- POS and heavy manufacturing require integrations.

Pricing & Packages

As of 2026 Q1& Q2 – Subscription plans by organisation and feature set pricing tiers. Wafeq keeps it simple with three main tiers (billed annually)

- Basic – AED 53/month. Good for freelancers and small startups.

- Standard – AED 125/month. Adds inventory and multi currency.

- Plus – AED 291/month. Includes payroll and advanced project tracking.

Technical support & after service

- Call support – Yes

- Email support – Yes

- Premium support – Yes

Reviews and Ratings

- Google Rating – 4.8 / 5

- TrustPilot Rating – 4.7 / 5

- UAE Public Rating – 9.3 / 10

3 – Zoho Books (UAE edition)

Zoho Books UAE Edition is a fully localized, FTA accredited cloud platform built specifically for Emirates businesses. It automates invoicing, reconciliation, and expense tracking while ensuring VAT Compliant Accounting Software standards and Corporate Tax readiness. Direct EmaraTax VAT filing, FTA Audit File (FAF) generation, UAE bank feeds, and self service customer portals make it one of the Best Accounting software in Dubai for SMEs seeking automation with compliance confidence.

Features

- All Native Features – VAT & CT modules, Invoicing, recurring invoices, estimates, bills, expense tracking, inventory, multi currency, project billing, basic reporting, client portal.

- UAE VAT compatibility – Yes, fully VAT compliant for UAE

- Corporate Tax (CT) compatibility – Yes, supports UAE corporate tax

- FTA compliance – Yes, officially FTA accredited tax accounting software

- POS compatibility – Limited integration with external POS systems

- Retail & trading compatibility – Yes, inventory, sales, purchase, multi currency and landed cost features suit trading/retail SMEs.

- UAE HR payroll compatibility – No, payroll handled via Zoho Payroll (separate product)

Advantages of Zoho Books

- Cloud based sync and safe storage,

- FTA accredited,

- Strong automation for VAT 201,

- Good integrations with banks, e commerce platforms,

- Fairly easy for SMEs.

Drawbacks of Zoho Books

- Not a full ERP,

- Native payroll for UAE is limited,

- Some advanced customisation and consolidation require higher plans or extra Zoho apps.

Pricing & Packages

As of 2026 Q1& Q2 – Tiered subscriptions are (Free, Standard, Professional, Premium etc.)

- Free – Free tier Ideal for businesses with revenue less than AED 200,000/year.

- Standard – AED 60/month (billed annually) or AED 69/month (billed monthly).

- Professional – AED 90/month (billed annually) or AED 129/month (billed monthly).

- Premium – AED 120/month (billed annually) or AED 159/month (billed monthly).

- Elite – AED 280/month (billed annually) or AED 349/month (billed monthly).

- Ultimate – AED 660/month (billed annually) or AED 799/month (billed monthly).

Technical support & after service

- Call support – Yes

- Email support – Yes

- Premium support – Yes

Reviews and Ratings

- Google Rating – 4.6 / 5

- TrustPilot Rating – 4.0 / 5

- UAE Public Rating – 9.0 / 10

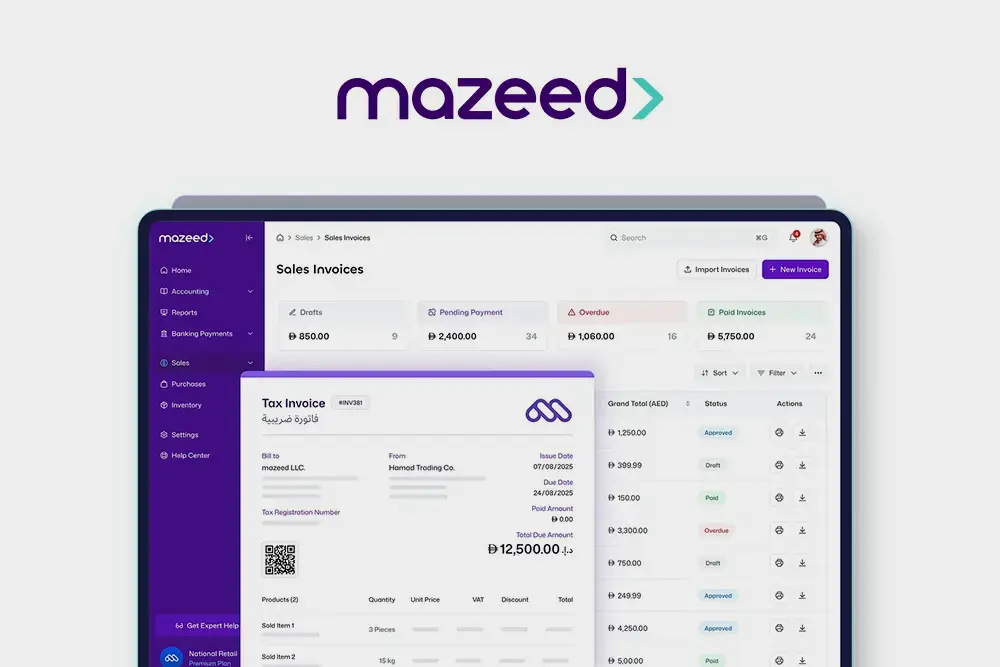

4 – Mazeed ONE

Mazeed ONE blends AI powered accounting software with on demand access to certified tax experts. Designed for UAE freelancers and SMEs, it enables document uploads via mobile and handles bookkeeping, VAT returns, and 9% Corporate Tax compliance. With tailored modules for Real Estate, Retail POS, and Manufacturing costing, it offers structured industry adaptability, positioning itself as intelligent VAT Compliant Accounting Software with human backed support.

Features of Mazeed ONE

- Native features – Accounting, invoicing, VAT & CT modules, real time dashboards, POS and e‑commerce integrations, bank connections, automated bookkeeping, FTA compliant e invoicing.

- UAE VAT compatibility – Yes, full VAT handling, FTA compliant software.

- Corporate Tax compatibility – Yes, explicitly Corporate Tax handled in full complianc

- FTA compliance – Yes, 100% FTA compliant.

- POS compatibility – Yes, Limited integrations with POS systems and e‑commerce.

- Retail & trading compatibility – Yes, ideal for UAE retailers, integrates POS and automates bookkeeping for retail operations.

- UAE HR payroll compatibility – No

Advantages of Mazeed ONE

- UAE focused,

- CT & VAT automation,

- FTA compliant e invoicing,

- Strong local support and integrations with POS and banks.

Drawbacks of Mazeed ONE

- Newer brand than Zoho/QuickBooks/Tally,

- Documentation and ecosystem may be less extensive,

- Complex HR and manufacturing need add‑ons.

Pricing & Packages

As of 2026 Q1& Q2 – Multiple cloud plans monthly with upgrade / downgrade options. pricing tiers focus on automation level and number of users/transactions.

- Starter – Free Tier best for freelancers and micro businesses

- Essential – 99 AED (billed monthly) best for small teams needing inventory & bank sync.

- Advance – 170 (billed monthly) best for businesses requiring multi currency & cost centers.

- Enterprise – Custom Pricing best for large firms needing dedicated account managers.

Technical support & after service

- Call support – Yes

- Email support – Yes

- Premium support – Yes

Reviews and Ratings

- Google Rating – 4.7 / 5

- TrustPilot Rating – 4.6 / 5

- UAE Public Rating – 8.7 / 10

5 – Xero

Xero is a scalable global cloud platform popular among UAE SMEs for invoicing, reconciliation, and real time reporting. While not locally built, it connects with selected UAE banks and integrates with 1,000+ third party apps for payroll and inventory needs. Businesses seeking flexible Accounting software Dubai solutions often choose Xero for customization. However, additional configuration is required to meet full VAT Compliant Accounting Software standards locally.

Features of Xero

- All Native features – Core accounting (GL, AR, AP), bank feeds, automated reconciliation, project tracking (on higher plans), basic inventory, expense claims, fixed asset register, VAT reports.

- UAE VAT compatibility – Yes, configured for UAE VAT

- Corporate Tax compatibility – No, Do not have UAE specific CT module.

- FTA compliance – Limited, supports VAT reporting aligned with FTA boxes, but is not FTA accredited and does not provide direct filing.

- POS compatibility – Yes, strong app ecosystem with POS integrations like Vend, Square, Shopify etc.

- Retail & trading compatibility – Yes, inventory, multi currency and cloud ecosystem work well for many retail and e commerce businesses, but requires add‑ons for full retail stack.

- UAE HR payroll compatibility – No, there is no native WPS specific module.

Advantages of Xero

- Clean, Easy to navigate User Interface,

- robust integrations,

- good for multi‑entity groups and remote teams,

- solid VAT workflows when properly configured.

Drawbacks of Xero

- Not FTA accredited,

- no direct FTA integration,

- relies on ecosystem for POS and payroll,

- Some SMEs in the UAE prefer region specific tools.

Pricing & Packages

As of 2026 Q1& Q2 – Multiple plans (Starter, Standard, Premium) with per organisation monthly fees.

- Starter – AED 100 (billed monthly)

- Standard – AED 180 (billed monthly)

- Premium – AED 275 (billed monthly)

Technical support & after service

- Call support – No

- Email support – Yes

- Premium support – Yes

Reviews and Ratings

- Google Rating – 4.5 / 5

- TrustPilot Rating – 4.3 / 5

- UAE Public Rating – 8.5 / 10

6 – QuickBooks (UAE Edition)

QuickBooks Online UAE Edition adapts Intuit’s global cloud engine to meet FTA compliance requirements. It supports bilingual Arabic and English tax invoices, connects with major UAE banks like Emirates NBD, ADCB, and RAKBANK, and simplifies reconciliation. As trusted Accounting software Dubai companies adopt, it blends global interface strength with regional VAT modules, making it practical for growing SMEs navigating UAE Corporate Tax and VAT regulations.

Features of QuickBooks

- All Native Features – General ledger, AR/AP, invoicing, expense tracking, bank feeds and reconciliation, inventory (Plus), basic budgeting, multi currency, reports, mobile app.

- UAE VAT compatibility – Yes, VAT ready.

- Corporate Tax compatibility – No, there is no native UAE CT module yet.

- FTA compliance – Limited, can generate VAT invoices and reports, but no direct e‑filing.

- POS compatibility – Yes, Limited integration with POS apps Vend, Shopify POS, Lightspeed.

- Retail & trading compatibility – Yes, modules are suitable for trading and retail SMEs.

- UAE HR payroll compatibility – No native WPS ready payroll for UAE.

Advantages of QuickBooks

- UI / UX Very user friendly,

- Strong ecosystem of add ons,

- Good reporting,

- Widely supported by UAE consultants.

Drawbacks of QuickBooks

- No direct FTA e‑filing,

- Native CT and UAE payroll are limited,

- Multi‑entity and advanced consolidation require workarounds.

Pricing & Packages

As of 2026 Q1& Q2 – Multiple cloud plans (Simple Start, Essentials, Plus) with per‑month pricing for UAE region

- Simple Start – AED 77 Ideal for startups & basic accounting.

- Essentials – AED 114 (billed monthly) Ideal for growing teams (up to 3 users).

- Plus – AED 169 (billed monthly) Ideal for inventory & budget management.

- Advanced – AED 327 (billed monthly) Ideal for large teams & deeper insights.

New customers frequently receive a 90% discount for the first three months of service.

Technical support & after service

- Call support – Yes

- Email support – Yes

- Premium support – Yes

Reviews and Ratings

- Google Rating – 4.4 / 5

- TrustPilot Rating – 4.0 / 5

- UAE Public Rating – 8.3 / 10

7 – Horizon (Horizon ERP)

Horizon ERP is a robust, FTA accredited system designed for high volume trading, distribution, and manufacturing sectors in the UAE. It automates VAT 201 returns, generates FTA Audit Files, and supports complex inventory like batch tracking and multi warehouse control. With Van Sales, HR payroll (WPS), and property management modules, it functions beyond simple Accounting software Dubai tools, delivering enterprise level operational depth.

Features of Horizon

- All Native features – Full ERP finance, AR/AP, GL, budgeting, VAT automation, FTA audit file, multi company and multi TRN, inventory, procurement, project and job costing, HR and payroll options.

- UAE VAT compatibility – Yes, financial accounting module is “complete VAT enabled” for UAE, including input/output VAT, RCM etc.

- Corporate Tax compatibility – Yes, CT can be configured with specific ledgers and reports.

- FTA compliance – Yes, generates FTA compliant tax invoices and VAT 201 returns.

- POS compatibility – Yes, Limited POS is available as separate integrations within the overall ERP stack.

- Retail & trading compatibility – Yes, strong ERP for trading, distribution and multi branch operations with inventory and logistics.

- UAE HR payroll compatibility – Yes, Horizon offers HRMS/payroll modules tuned to Middle East laws, UAE WPS support can be included.

Advantages of Horizon

- End to end ERP with UAE VAT built in,

- Scalable to 100s of users,

- Modules for finance,

- Inventory, HR,

- Logistics and more.

Drawbacks of Horizon

- Higher implementation cost/complexity than SME cloud tools,

- On prem or private hosting common,

- Requires project based rollout and training.

Pricing & Packages

As of 2026 Q1& Q2 – Project based ERP pricing (licence + implementation + support) quotes are customised per modules, user count and deployment type. You pay a one time license fee plus an Annual Maintenance Contract (AMC)

- Standard – Starts from AED 2,500 as a one-time perpetual license fee. (Single User)

- Professional – Starts from AED 7,000 for a base setup of 5+ users (Multi User)

- Enterprise – Custom pricing depending on the integration of advanced modules like HR/Payroll with WPS or complex inventory.

- Online Cloud Package – Starts from AED 150 (monthly billed)

Technical support & after service

- Call support – Yes

- Email support – Yes

- Premium support – Yes

Reviews and Ratings

- Google Rating – 4.5 / 5

- TrustPilot Rating – 4.4 / 5

- UAE Public Rating – 8.3 / 10

8 – Sage (Sage 50 / 300 for UAE)

Sage offers tiered solutions from startups to multinational enterprises in the UAE. Sage 50 Middle East Edition meets FTA standards, while Sage 300 and Intacct provide advanced ERP capabilities. Integrated WPS payroll, VAT automation, Corporate Tax reporting, and EmaraTax ready outputs make Sage a scalable option among the Top 10 Accounting software in UAE for companies expanding across multiple entities.

Features of Sage

- Native features – Accounting, inventory, order processing, VAT reporting, dashboards, multi currency, with Sage HR / People, HR, payroll, leave, self service portals.

- UAE VAT compatibility – Yes, Sage 50 edition used in UAE is VAT ready, automates VAT calculation and reporting for FTA.

- Corporate Tax compatibility – No, CT can be handled through accounts and reports, but UAE CT‑specific automation is still evolving.

- FTA compliance – Yes, produces VAT reports and invoices that meet FTA requirements when configured; filing is via FTA portal.

- POS compatibility – Yes, POS achieved via Sage compatible POS or partner solutions, not native in core Sage 50/300.

- Retail & trading compatibility – Yes, widely used by SMEs with inventory and multi location features.

- UAE HR payroll compatibility – Yes, Sage 300 People and other Sage HRMS products handle HR & payroll in line with local regulations (including WPS via partners).

Advantages of Sage

- Mature mid market solution,

- strong inventory and multi company features,

- plus integrated HR and payroll via Sage HR and Sage 300 People.

Drawbacks of Sage

- On‑prem or hybrid deployments often needed,

- implementation through partners adds cost,

- UI is less modern than newer cloud native apps.

Pricing & Packages

As of 2026 Q1& Q2 – Licence and subscription pricing vary by edition, user count and modules.

Sage Business Cloud Accounting

- Accounting Start – AED 45/month

- Accounting Standard – AED 92/month

- Accounting Plus – AED 110/month

Sage 50 Edition

- Single User License – AED 2,800 + VAT. (one time fee)

- 3 User License – AED 5,400 + VAT. (one time fee)

- Subscription Model: Starting AED 1,830 per year.

Sage 300 Cloud

- Subscription Pricing – Starting AED 550 per month, per user

- Implementation Fee – Starting AED 36,700

Sage Intacct (Enterprise Cloud)

- Annual Subscription: Starting AED 44,000 per year

Technical support & after service

- Call support – Yes

- Email support – Yes

- Premium support – Yes

Reviews and Ratings

- Google Rating – 4.2 / 5

- TrustPilot Rating – 3.9 / 5

- UAE Public Rating – 8.0 / 10

9 – Oracle NetSuite / Oracle Fusion

Oracle delivers enterprise grade cloud ERP solutions tailored to UAE regulatory environments. NetSuite integrates finance, CRM, inventory, and e commerce in one system, with built in VAT 201 and Corporate Tax modules. Oracle Fusion supports complex global enterprises with deeper supply chain and manufacturing capabilities. For corporations seeking high level governance, these platforms represent advanced Best Accounting software in Dubai options.

Features of Oracle

- Native features – Full ERP (GL, AR / AP, inventory, projects, revenue management), SuiteTax, UAE specific VAT / FAF reports, dashboards, multi book, multi currency, integration framework.

- UAE VAT compatibility – Yes, SuiteTax and international tax reports support UAE VAT and audit‑file requirements.

- Corporate Tax compatibility – Yes, CT can be modelled via tax rules, accounts and custom reports, large organisations already use NetSuite/Oracle for CT worldwide.

- FTA compliance – Yes, has a UAE VAT report and specific UAE FTA VAT Audit File (FAF) export plus tax‑code mapping aligned with FTA.

- POS compatibility – Yes, Limited POS through Oracle or third‑party POS applications integrated to NetSuite.

- Retail & trading compatibility – Yes, strong for multi store and omni channel retail, distribution and complex trading.

- UAE HR payroll compatibility – Yes, payroll and HR through Oracle HCM or local WPS compliant partners.

Advantages of Oracle

- Very scalable,

- Strong multi entity and global tax,

- Configurable UAE VAT/FAF reports,

- Good auditability.

Drawbacks of Oracle

- High total cost of ownership,

- Heavier implementation,

- Overkill for small businesses.

Pricing & Packages

As of 2026 Q1& Q2 – Annual subscription with base licence + per user fees and modules, pricing is quote based for UAE enterprises.

- Oracle NetSuite – Starting at AED 3,670/month for core ERP features.

- NetSuite OneWorld AED 7,340/month (Multi entity)

- Oracle Fusion Cloud – Starting from AED 48/employee per month (HR & Payroll)

Technical support & after service

- Call support – Yes

- Email support – Yes

- Premium support – Yes

Reviews and Ratings

- Google Rating – 4.3 / 5

- TrustPilot Rating – 4.2 / 5

- UAE Public Rating – 7.9 / 10

10 – CrossVal

CrossVal is a Dubai based, FTA approved cloud accounting platform designed specifically for UAE and GCC markets. It generates VAT reports and FTA Audit Files in two clicks and includes AI powered Corporate Tax modules. With native integration to banks like Mashreq, Emirates NBD, and FAB, CrossVal positions itself as a strong local first alternative in the Accounting software Dubai ecosystem.

Features of CrossVal

- Native features – Core accounting, invoicing, VAT module, basic inventory, bank feeds, simple dashboards, some include light project or expense features.

- UAE VAT compatibility – Yes, VAT compliant for UAE

- Corporate Tax compatibility – Yes, newer versions typically add CT support.

- FTA compliance – Yes, can generate FTA compliant invoices and summaries.

- POS compatibility – No

- Retail & trading compatibility – Yes, oriented to SMEs with product and inventory features.

- UAE HR payroll compatibility – No

Advantages of CrossVal

- Simple cloud user interface,

- Local VAT focus,

- Lower cost than big ERPs,

- Quick setup for small businesses.

Drawbacks of CrossVal

- Less mature ecosystems,

- Possible gaps in CT or advanced reporting,

- May not scale for complex groups.

Pricing & Packages

As of 2026 Q1& Q2 – CrossVal offers a tiered subscription model designed for UAE businesses, with a 14-day free trial across all plans.

- Early Stage – Starting AED 180

- Growth Stage – Starting AED 550

- Enterprise – Custom Pricing

Technical Support & After Service

- Call support – Yes

- Email support – Yes

- Premium support – Limited

Reviews and Ratings

- Google Rating – 4.6 / 5

- TrustPilot Rating – 4.2 / 5

- UAE Public Rating – 7.5 / 10

Final Decision is Yours to Take

In the UAE, accounting is no longer about bookkeeping. It is about governance, compliance, and strategic clarity. Choosing from the Top 10 Accounting software in UAE means selecting a system that protects your business against VAT errors, Corporate Tax risks, payroll penalties, and regulatory setbacks. The right Accounting software Dubai companies invest in must function as true VAT Compliant Accounting Software, adaptable to sector needs including Automotive Accounting Software and complex trading environments.

The Best Accounting software in Dubai is not the most popular one. It is the one aligned with your growth, industry, and compliance future. Choose wisely.

Frequently Asked Questions (FAQs)

1. What is FTA approved accounting software in UAE?

FTA Approved Accounting Software in UAE refers to systems recognized by the Federal Tax Authority for generating VAT-ready invoices, VAT 201 returns, and audit files aligned with UAE tax rules. While not legally mandatory for all, using such tools protects accuracy and audit readiness. Many platforms within the Top 10 Accounting software in UAE category meet these compliance benchmarks.

2. Is it mandatory to use FTA approved software for VAT?

No, it is not legally mandatory. But using non compliant systems increases the risk of filing errors and penalties. Choosing FTA Approved Accounting Software in UAE ensures smoother reporting and fewer surprises during audits. Most businesses selecting reliable Accounting software Dubai providers prefer tools already aligned with FTA standards.

3. Which accounting software is best for UAE VAT compliance?

The best options are those built as true VAT Compliant Accounting Software with automated VAT calculations, bilingual invoices, and FTA ready exports. Several platforms listed among the Top 10 Accounting software in UAE deliver strong VAT compliance, especially cloud based Accounting software Dubai solutions tailored for local tax structures.

4. How does accounting software automate VAT returns?

Modern VAT Compliant Accounting Software automatically tracks input and output VAT, calculates payable amounts, generates VAT 201 summaries, and exports FTA-compatible files. Some tools integrate directly for e-filing. The strongest platforms within the Top 10 Accounting software in UAE simplify what once required manual spreadsheets and high compliance risk.

5. Cloud based or desktop which is better for UAE businesses?

Cloud based Accounting software Dubai businesses choose offers mobility, auto updates, and real-time compliance enhancements. Desktop tools suit offline heavy trading sectors but may require hosting for multi user access. Many companies now prefer cloud solutions within the Top 10 Accounting software in UAE for scalability and regulatory adaptability.

6. Does the software support UAE corporate tax (CT)?

Yes, modern FTA Approved Accounting Software in UAE supports the 9% Corporate Tax introduced post 2023, alongside VAT tracking. The best VAT Compliant Accounting Software calculates CT liabilities, maintains audit trails, and prepares reports aligned with UAE tax frameworks, ensuring full financial visibility beyond just VAT filings.

7. What features are essential for FTA e-invoicing?

Essential features include bilingual Arabic / English invoices, TRN display, structured VAT breakdowns, QR codes, and secure digital records. Leading VAT Compliant Accounting Software platforms within the Top 10 Accounting software in UAE are preparing for stricter e-invoicing mandates, helping businesses stay ahead of regulatory enforcement timelines.

8. How much does top UAE accounting software cost?

Cloud based Accounting software Dubai solutions typically range between affordable monthly subscriptions, while enterprise ERPs require customized annual pricing. Costs vary based on users, modules, and compliance features. Businesses comparing the Top 10 Accounting software in UAE should evaluate value, compliance strength, and scalability not just price.

9. Can it handle retail / POS and multi branch trading?

Yes. Advanced FTA Approved Accounting Software in UAE supports POS integration, multi warehouse inventory, and branch wise VAT reporting. Retailers and trading firms benefit from systems listed among the Top 10 Accounting software in UAE, especially those designed to function as structured VAT Compliant Accounting Software for multi location control.

10. How to migrate from old software to VAT compliant UAE tools?

Migration starts with exporting ledgers, invoices, and VAT codes, mapping them correctly into the new VAT Compliant Accounting Software. Many Accounting software Dubai providers offer structured migration services to minimize downtime. Choosing an FTA Approved Accounting Software in UAE ensures your transition strengthens compliance rather than disrupts it.

Related Articles

- Beginners Guide to Payroll and Tax Services in UAE, 11 Things you need to know

- Copy this Bullet Proof HR Recruitment Process in UAE for Your Company in 2026

- HR Policies in UAE (2026 Guide) Legal HRM Compliance Explained

- Learn Everything About HR Document Management System (DMS) in 2026

- The Only Onboarding and Offboarding Process UAE Companies Need in 2026 (Playbook + Checklist)

- These 10 Latest HR Trends Are Redefining Traditional HR Priorities in Dubai 2026

- These 60+ Accounting Interview Questions Decide Who Gets Hired in Dubai & UAE

- Top 10 Accounting Software in UAE, 2026 Most Powerful Accounting Software Ranked